What is the Blockchain Protocol Curve (CRV)?

Curve is a decentralized exchange for stablecoins that uses an automated market maker (AMM) to manage liquidity.

Curve Finance, like Uniswap, operates as a decentralized exchange (DEX) utilizing an Automated Market Maker (AMM) mechanism.

The CRV tokens are powering the ecosystem, and are used as a governance token, incentivizing liquidity providers to stake their tokens into the pools in exchange for fees collected from traders. Check the CRV coin price and data with live charts.

The Curve DAO was formed to provide further decentralization and governance over the protocol.

What is the purpose of CRV and how does it work as a blockchain protocol

CRV, or Curve DAO Token, is a decentralized exchange (DEX) built on the Ethereum blockchain developed by Michael Egorov. The main purpose of CRV is to provide an efficient way to swap stablecoins with low slippage and low fees. As a blockchain protocol, CRV operates on a decentralized network of computers, known as nodes. These nodes work together to validate transactions and ensure the security and integrity of the network. Upon completion, transactions are recorded on a digital ledger, which is publicly visible and transparent. The beauty of CRV lies in its ability to offer a more efficient and cost-effective way for traders to exchange stablecoins, making it a strong contender in the rapidly growing world of DeFi platforms and applications.

The Curve protocol allows users to trade between digital assets like USDT/USDC/DAI, BTC/ETH, SNX/LINK, and many other ERC-20 tokens with low fees. As an AMM-based DEX, the order books are generated from liquidity pools instead of individual orders, providing better slippage than traditional exchanges.

When placing a trade on Curve, users can earn additional rewards by taking part in the platform’s yield farming programs. The reward structure is designed to provide benefits to liquidity providers, traders, and users who stake their tokens.

The Curve decentralized autonomous organization also employs a voting model that allows members to influence the protocol’s direction and development the more a user has CRV the higher the voting rights. These votes can be used to decide on changes such as listing new tokens or adjusting liquidity rewards.

What are liquidity pools?

Liquidity pools are collections of tokens held in smart contracts, allowing for exchange or withdrawal based on the contract's defined parameters. By contributing liquidity to a pool, you have the chance to earn trading fees and potential rewards.

If you're new to Ethereum or DeFi, grasping the concept of liquidity pools may appear daunting. Simply put, liquidity pools involve tokens residing in smart contracts. For instance, let's consider a pool containing both DAI and USDC tokens, where the exchange ratio is fixed at 1 DAI = 1 USDC. In this scenario, the pool holds a total of 1,000 tokens, evenly split between 1,000 DAI and 1,000 USDC.

Now, if Trader 1 exchanges 100 DAI for 100 USDC, the pool will have a new balance of 1,100 DAI and 900 USDC. As a result, the price will slightly favor USDC to encourage other traders to swap their USDC for DAI, restoring equilibrium to the pool.

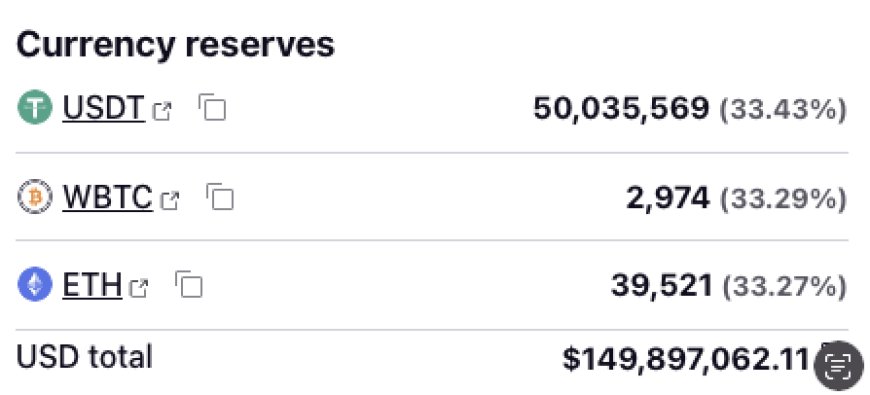

Such details are available for each pool and provide an opportunity to optimize your deposits.

Base vAPY

To the functions of different pools, it is crucial to grasp how Curve generates revenue for liquidity providers. Trading fees contribute to Curve's earnings. Whenever someone uses Curve, whether, through the Curve website, 1inch, Paraswap, or another dex aggregator, a small fee is distributed among liquidity providers. As a result, the base vAPY increases in tandem with Curve's trading volume.

Certain pools (Compound, PAX, Y, BUSD) also earn interest from lending protocols. Behind the scenes, these pools utilize lending protocols such as Compound or AAVE to generate additional interest for liquidity providers. While this allows these pools to thrive when lending rates are high, it's important to note that it introduces more layers of risk.

All pools benefit from trading fees, while some pools also earn interest from lending. Moreover, certain pools offer additional incentives. Additionally, providing liquidity on Curve Finance grants you the opportunity to receive CRV. The amount of CRV received by each liquidity gauge is determined by the DAO's allocation.

Each time a trade occurs on Curve.fi, liquidity providers (those who have deposited funds into Curve) receive a small fee distributed evenly among all providers. This explains why high vAPYs tend to occur on days with substantial volume and volatility. It's worth noting that since fees are volume-dependent, daily vAPYs can fluctuate greatly, ranging from low to high.

What are Curve fees?

Swap fees on Ethereum for exchanging stable coins are typically around 0.04%, widely recognized as the most efficient option those are some of the lower fees on the market. Deposits and withdrawals incur fees ranging from 0% to 0.02%, depending on the presence of an imbalance. Imagine a scenario where fees were 0% - users could seamlessly deposit in USDC and withdraw in USDT without any cost implications. It's noteworthy that balanced deposits or withdrawals are exempted from fees altogether. This approach ensures enhanced writing quality while retaining the essence of the original content.

Understanding Curve Pools

As you should know, providing liquidity has its fair share of risks so in this article, we review the different Curve pools to help you find one that matches your risk tolerance while explaining the risks involved with being a liquidity provider on Curve.

There are currently several Curve pools with new pools added all the time.

It’s important to understand that when you provide liquidity to a pool, no matter what coin you deposit, you essentially gain exposure to all the coins in the pool which means you want to find a pool with coins you are comfortable holding.

Curve official website: https://curve.fi/