What is ThorChain (RUNE)? Cross-chain swaps DEX explained

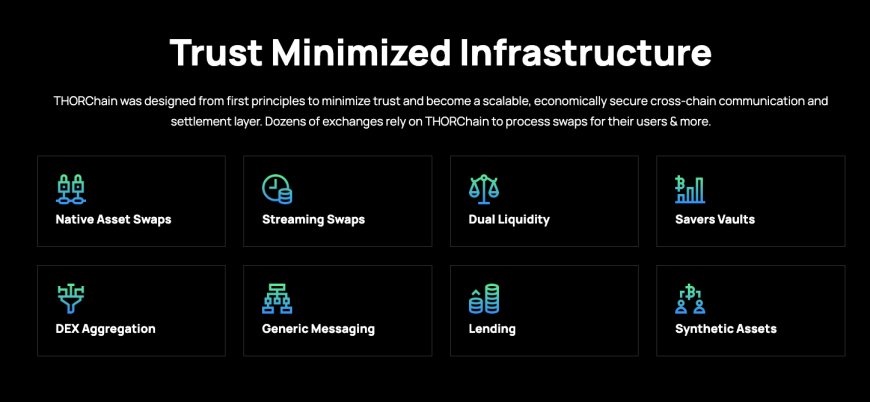

ThorChain is a blockchain protocol and digital asset exchange that allows users to store and trade decentralized assets. It provides users with the ability to create liquidity pools, create new token trading pairs, and access an array of sophisticated financial instruments such as margin trading, short selling, derivatives, and more.

Thor Chain is a decentralized exchange, liquidity protocol built on the blockchain.

The thorchain protocol allows users to seamlessly do token swaps, trade, and provide liquidity in a truly decentralized ecosystem.

With Thor Chain's unique algorithm, anyone can become a liquidity provider and earn passive income by staking their crypto assets.

The native token of thorchain is called RUNE and its used for Settlement Asset, Network Security, Governance and Inccentives.

You can check the Rune price to get more data about total supply, market cap, circulating supply and live charts.

How Thor Chain works

• Thor Chain is a decentralized liquidity protocol that uses cross-chain bridges to enable seamless trading of assets across different blockchains. For exemple, you can swap Bitcoin for Ethereum in no time with just 2 clicks and a very low gas fee (slip-based fees). It is a cross-chain exchange.

• It also allows anyone to become a liquidity provider by staking their assets in a pool. The pool then earns trading fees, which are distributed among the liquidity providers. This means that anyone can earn passive income by providing liquidity to the platform. It is a decentralized liquidity network.

• The Decentralized protocol Thor Chain uses an algorithm called Continuous Liquidity Pool (CLP), which ensures that the price of the asset remains stable even as the demand and supply fluctuate. It does this by adjusting the pool's asset ratio in real-time, based on the market conditions. This eliminates the need for order books and reduces the risk of market manipulation. (source: Thor Chain)

The advantages of using Thor Chain for DeFi transactions

Thor Chain blockchain protocol offers several advantages to users who want to participate in decentralized finance (DeFi), ThorChain 3 pillars: Security, Liquidity, and Volume.

- Security: The network is improved via either Functional, Procedural, or Economic Security via thorchain nodes.

- Liquidity: great incentives with passive incone for LP providers to increase Total Value Locked (TVL), or better UX around providing liquidity (Savers) for asset pool.

- Volume: it is more accessible, with better Swap UX as it allows users to trade assets across different blockchains without having to go through an intermediary.

(source: Thor Chain Whitepapers)

How to get started with Thor Chain

Getting started with Thor Chain is easy. The first step is to set up a wallet like MetaMask, Trust Wallet, or Binance Chain Wallet.

Once you have set up your wallet, you can buy BNB (Binance Coin) or any other asset that is supported by Thor Chain.

Next, you can connect your wallet to Thor Chain and start trading or providing liquidity to the platform. To trade, simply select the asset you want to trade and the asset you want to receive, and the platform will automatically calculate the exchange rate. To provide liquidity, you need to stake your assets in a pool and earn trading fees.

What is decentralized finance (DeFi)?

Decentralized finance (DeFi) is a new paradigm in the world of finance that is built on the blockchain and revolutionize the crypto markets. It aims to create a more open, transparent, and accessible financial system that is not controlled by any central authority. DeFi platforms use smart contracts to automate financial transactions and allow users to access financial services without intermediaries. This means that users can trade, borrow, lend, and earn interest without having to rely on traditional financial institutions or centralized crypto exchange.

Common challenges and risks in decentralized finance

Decentralized finance is a relatively new concept, and there are several challenges and risks associated with it. The first challenge is the lack of regulation, which can make it difficult to protect users from fraud or scams. Second, there is a risk of smart contract bugs or vulnerabilities, which can lead to the loss of funds. Third, there is a risk of impermanent loss, which is the loss of value that occurs when providing liquidity to a pool.

To mitigate these risks, it is important to do your own research and only invest what you can afford to lose. It is also important to use reputable platforms and to be aware of the risks associated with each platform.

### 1. Securely setting up your wallet

Before you can start using Thor Chain, you need to set up a wallet that is compatible with the platform. There are various wallet options available, such as MetaMask and Trust Wallet. It is essential to choose a wallet that is reputable and has a strong security track record. Once you have chosen a wallet, follow the instructions provided by the wallet provider to set it up securely.

### 2. Understanding impermanent loss

One of the key concepts in decentralized finance is impermanent loss. When you provide liquidity to Thor Chain, you are essentially depositing your assets into a liquidity pool. In return, you receive liquidity provider (LP) tokens that represent your share of the pool. However, the value of these LP tokens can fluctuate due to changes in the price of the assets in the pool. This fluctuation in value is known as impermanent loss.

### 3. Diversifying your portfolio

Diversification is a fundamental principle of investing, and it applies to decentralized finance as well. By diversifying your portfolio across different assets and liquidity pools, you can minimize your exposure to any single asset or pool. This strategy helps to spread the risk and increase the potential for earning passive income.

The value of RUNE is poised to increase in the next few years. With the possibility of earning rewards from rune holders by staking and participating in liquidity pools, make sure to diversify your portfolio across different assets and liquidity pools to maximize your potential returns.

Thor Chain blockchain official website: https://thorchain.org/

Thor chain wallet: https://app.thorwallet.org/

ThorChain explorer: https://thorchain.net/dashboard